📘 Contents

- What is Cryptocurrency?

- Crypto vs Traditional Money

- Problems Crypto Aims to Solve

- How Does Crypto Work? Blockchain Explained

Crypto Mining: How Miners Earn Money

- Environmental Impact of Cryptocurrency

Investment Opportunities for Retail Investors

Crypto Trading Platforms in Pakistan

Risks and Security in Crypto Investments

Institutional Investors: How They Shape Crypto

Potential Returns from Crypto Investments

Why Governments Are Skeptical About Crypto

- Crypto Regulations in Pakistan

- Common Crypto Pitfalls to Avoid

- Conclusion: Is Crypto the Future?

What is Cryptocurrency?

Cryptocurrency, often called "crypto," is digital or virtual money secured using cryptography. Unlike traditional currencies like the Pakistani Rupee (PKR), crypto isn't controlled by any central authority like the State Bank of Pakistan. Instead, cryptocurrencies operate on a decentralized system called blockchain technology.

Simply put, cryptocurrencies allow you to make secure transactions online directly from one person to another without involving banks or intermediaries. Every crypto transaction gets recorded on a decentralized ledger (blockchain), ensuring transparency and preventing fraud.

Crypto is digital money that lets you send and receive payments securely without banks or middlemen, using blockchain to keep transactions transparent and safe.

Think of crypto like sending a WhatsApp message directly to your friend. Normally, when you send money online, your bank approves and processes the payment, acting as a middleman. With crypto, there's no bank involved. Instead, the blockchain confirms and records the payment securely and transparently.

This guide will cover everything you need to know about crypto—from understanding blockchain, mining, and investment opportunities, to dealing with security, risks, and regulations in Pakistan. By the end, you'll clearly understand why crypto could potentially shape our financial future.

Crypto vs Traditional Money

Traditional money, such as Pakistani Rupees (PKR), US Dollars (USD), or Euros, is what we use every day. These currencies are also known as "fiat" money—issued and regulated by governments and central banks, like Pakistan's State Bank. Fiat currencies exist in physical form (cash notes and coins) as well as digital form (bank accounts, online payments, etc.).

Cryptocurrency, however, is entirely digital. It has no physical notes or coins. Unlike fiat currencies, crypto is not issued by governments and does not rely on central authorities. Instead, cryptocurrencies like Bitcoin and Ethereum run on decentralized networks that use blockchain technology for secure transactions.

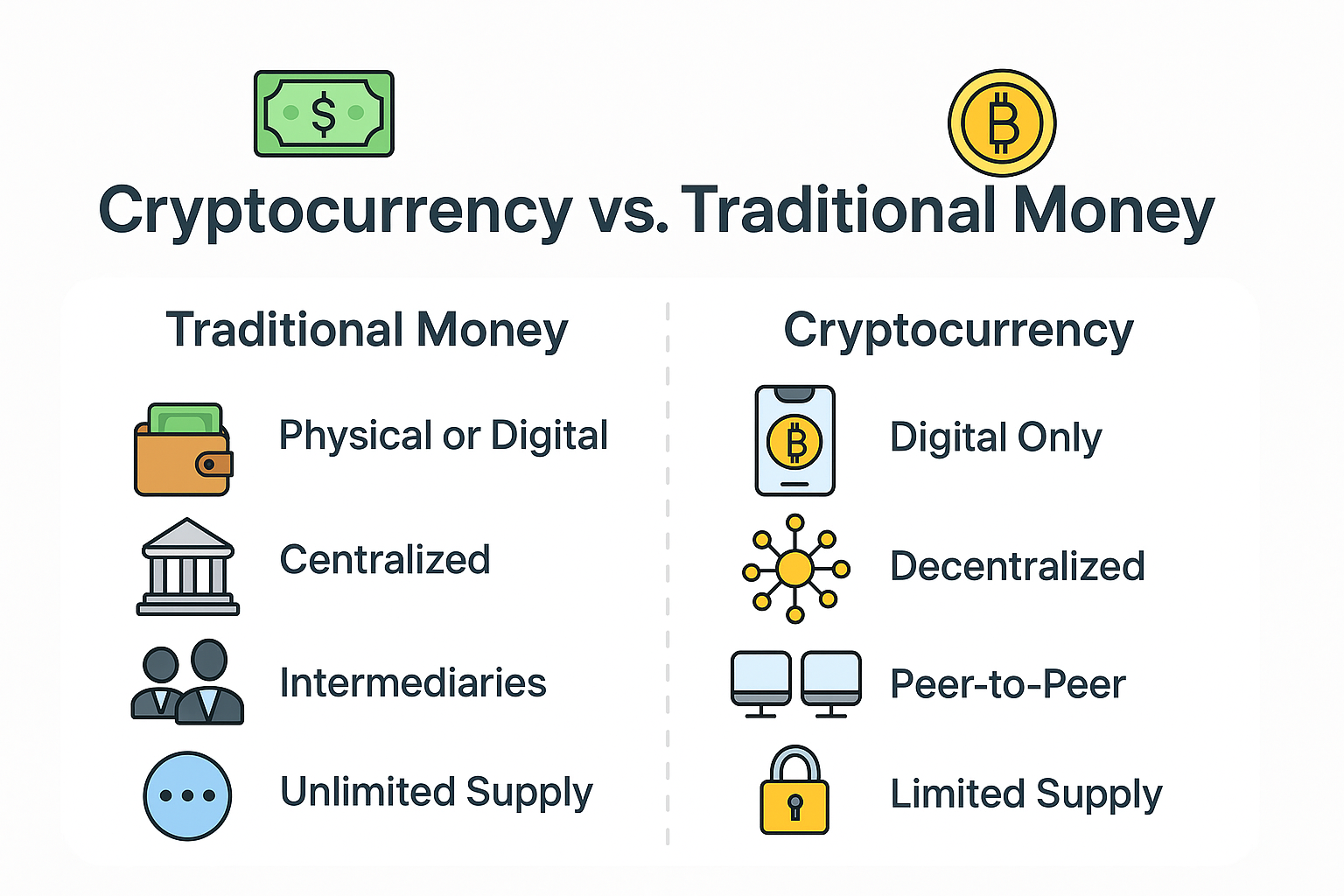

Here's a clear comparison of the key differences between crypto and traditional money:

Control and Regulation: Traditional money is controlled by central banks, like the State Bank of Pakistan, whereas crypto is decentralized and not governed by any single entity.

Physical Presence: Traditional currencies exist both physically and digitally, while crypto exists solely in digital form.

Transparency: Crypto transactions are publicly recorded on a blockchain, making them transparent, secure, and difficult to manipulate. Traditional banking transactions are private and not publicly accessible.

Transaction Speed and Costs: Crypto transactions, especially international ones, can be faster and cheaper compared to traditional banking methods, which can take days and involve significant fees.

Inflation and Supply: Fiat currencies can experience inflation due to government policies, causing the value of money to decrease over time. Cryptocurrencies like Bitcoin have a limited supply, protecting against inflation.

Crypto offers decentralized control, transparency, and lower transaction costs compared to traditional currencies regulated by governments.

Imagine traditional money as a notebook owned by one person who controls who can write in it, what gets written, and when. Crypto, on the other hand, is like a shared Google Doc that anyone can view, ensuring transparency, security, and fairness because no single person can alter it secretly.

Understanding these differences helps you grasp why crypto has become popular worldwide. It promises a more open financial system with fewer barriers, especially valuable in countries where people may lack easy access to banks or face high transaction fees—situations familiar to many in Pakistan.

Problems Crypto Aims to Solve

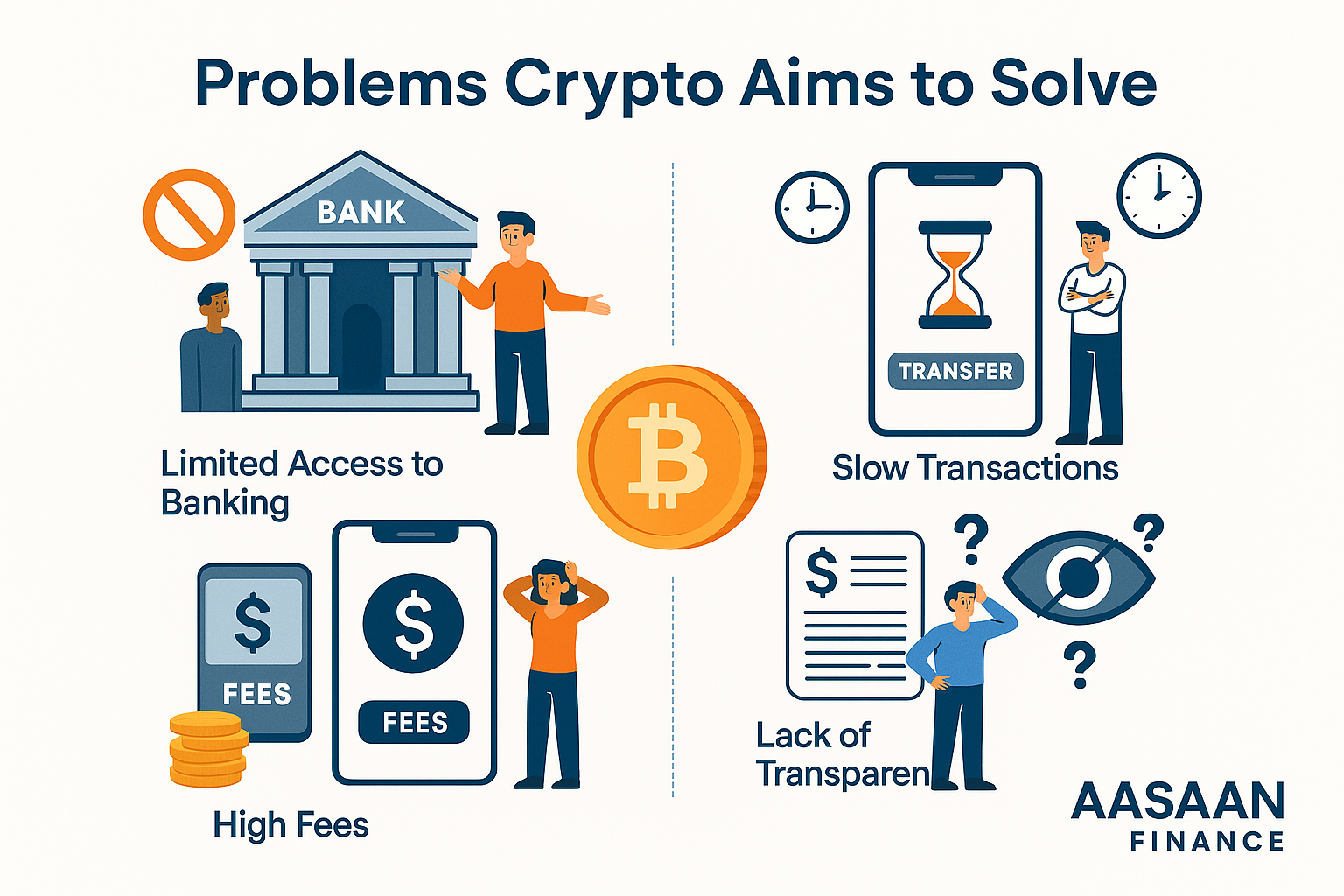

Cryptocurrency isn't just digital money; it's a solution designed to fix several critical issues in traditional financial systems. Let's explore some of the key problems crypto addresses:

- 🚧 Slow and Expensive International Transfers: Traditional banks take several days and charge hefty fees for international transactions. Crypto allows almost instant transactions across borders at a significantly lower cost.

- 🔒 Lack of Financial Inclusion: Millions of people worldwide, including many in rural areas of Pakistan, don't have access to traditional banking. Crypto provides these individuals a way to participate in the financial system using only a smartphone and internet connection.

- 🌐 Currency Devaluation and Inflation: Governments sometimes print more money to manage debts or stimulate economies, causing inflation and reducing the currency's value over time. Cryptocurrencies like Bitcoin have a fixed supply, protecting against inflation.

- 🏦 Centralization and Control: Traditional financial systems are centrally controlled by banks and governments, creating vulnerabilities, such as corruption, misuse of power, or unfair regulations. Crypto provides decentralized systems, removing power from central entities and giving control back to users.

- 🔍 Transparency Issues: In traditional banking, users have limited visibility over how institutions handle their money. Crypto’s blockchain provides complete transparency, allowing users to verify transactions independently and securely.

- 🛡️ Security and Fraud Prevention: Banks and payment providers sometimes face security breaches, fraud, and identity theft. Cryptocurrency's blockchain uses cryptography, making it incredibly difficult to alter records or commit fraud.

Crypto addresses critical financial issues like slow transactions, high costs, inflation, centralization risks, and lack of transparency in traditional systems.

To visualize how crypto solves these problems, think of sending money internationally like mailing a letter via Pakistan Post—it might take days, be expensive, and there’s no guarantee it'll arrive safely. Crypto is more like sending a WhatsApp message—it’s instant, cost-effective, secure, and trackable.

In countries like Pakistan, where financial inclusion is low and inflation is consistently high, cryptocurrency presents an opportunity for individuals to gain financial freedom, protect their savings from inflation, and conduct global transactions affordably and efficiently.

How Does Crypto Work? Blockchain Explained

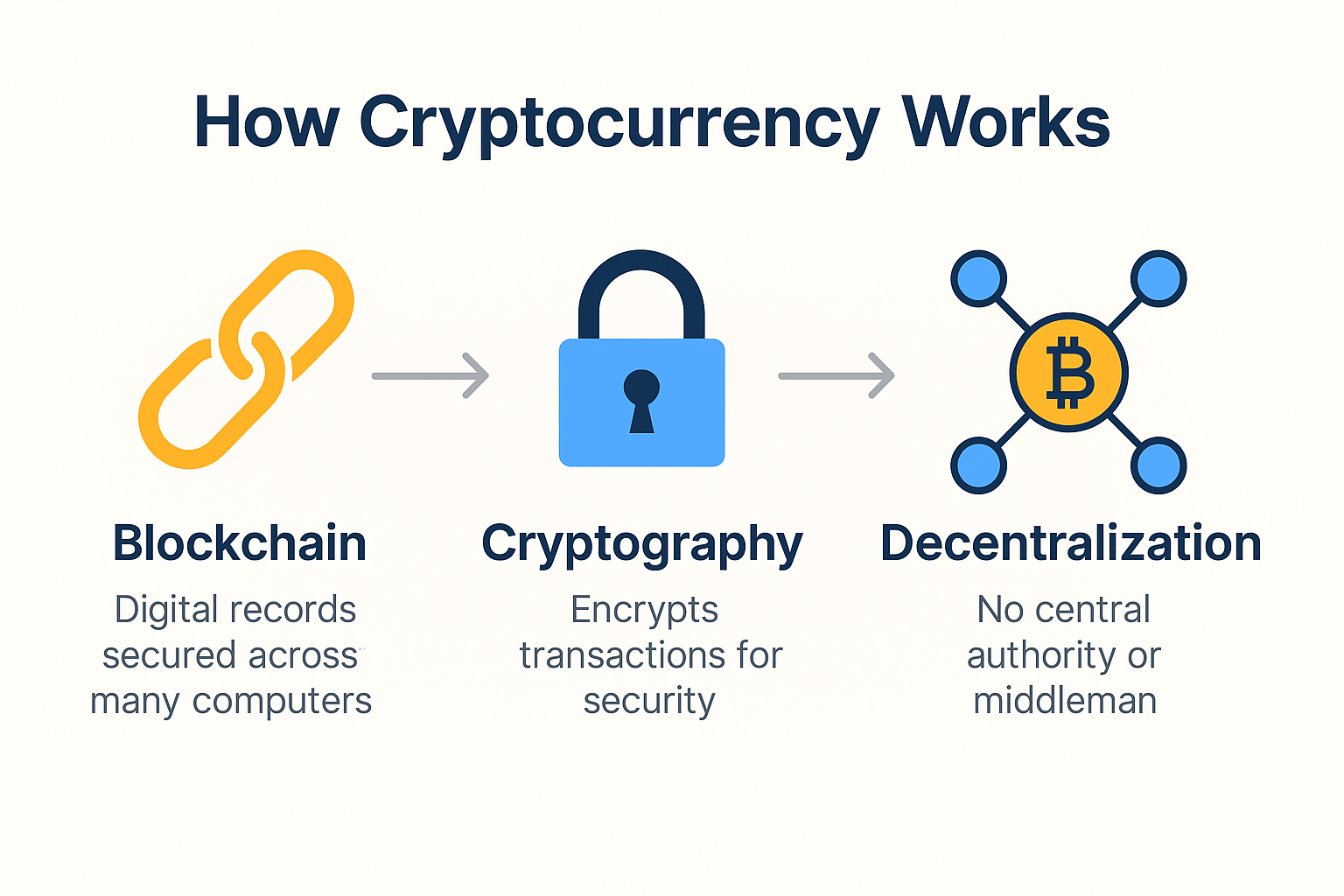

At the heart of every cryptocurrency lies a revolutionary technology called blockchain. While the term may sound intimidating, blockchain is simply a digital ledger or record of transactions that's maintained by thousands of computers worldwide, rather than a single institution like a bank.

1. Initiating Transactions: Suppose Ali sends 1 Bitcoin (BTC) to Sara. This transaction is broadcasted to a global network of computers (nodes).

2. Verification by Nodes: These computers verify the transaction, checking if Ali actually owns that Bitcoin and if the transaction details are correct.

3. Grouping into Blocks: Verified transactions are grouped together into "blocks." Each block holds multiple transactions, similar to pages in a ledger.

4. Adding the Block: Once a block of transactions is verified and approved by the network, it's added to a chain of previous blocks—hence the name "blockchain." Each block contains a reference to the previous block, creating a secure, unbreakable chain.

5. Immutable Record: After the block is added, it’s nearly impossible to alter or delete transactions because you would need consensus from thousands of decentralized computers, making the system incredibly secure.

Blockchain technology securely records crypto transactions across thousands of decentralized computers, ensuring transparency, security, and immutability.

Imagine blockchain like a digital notebook that thousands of people own simultaneously. Every time a new entry (transaction) is added, it’s immediately updated in everyone's notebook. If someone tries to alter or erase an entry, everyone else notices and rejects the change. This collective agreement or "consensus" ensures trust and security in blockchain networks.

Blockchain doesn't just support cryptocurrencies—it’s a transformative technology with potential applications in healthcare, property records, voting systems, and much more. The decentralized nature, combined with transparency and security, positions blockchain as a foundational technology for the future digital economy.

Crypto Mining: How Miners Earn Money

Crypto mining is the process of verifying and adding cryptocurrency transactions to the blockchain. Miners use powerful computers to solve complex mathematical problems, ensuring transactions are valid and securing the network. In exchange, miners earn rewards in the form of cryptocurrency—this is how new crypto coins are created.

Miners are the workers who solve computationally intensive mathematical puzzles to generate new coins and get rewards.

Here’s a step-by-step breakdown of how crypto mining works:

1. Transaction Broadcasting: When someone makes a crypto transaction (e.g., Ali sends Bitcoin to Sara), it gets broadcasted to the blockchain network.

2. Transaction Pool: Transactions first enter a "pool" of unconfirmed transactions awaiting verification.

3. Miners Compete: Miners use specialized hardware and software to solve complex mathematical puzzles. These puzzles ensure transactions are valid and secure the blockchain against fraud.

4. Block Creation and Reward: The first miner to successfully solve the puzzle adds a new block containing these verified transactions to the blockchain. This miner receives a "block reward"—a certain amount of crypto coins—and transaction fees from users.

5. Blockchain Update: Once the new block is added, the entire network updates its records. Miners then start competing to solve the next block.

Crypto miners earn rewards by verifying transactions, solving puzzles, and securely adding new blocks to the blockchain network.

Think of crypto mining like a competitive puzzle-solving contest. Imagine thousands of people racing to complete a complex jigsaw puzzle. The first person who completes it correctly receives a reward. Similarly, miners compete to solve blockchain puzzles, and the winner gets rewarded with cryptocurrency.

It's important to note that mining is resource-intensive, requiring specialized hardware (often called ASIC miners) and significant electricity consumption. For cryptocurrencies like Bitcoin, the puzzles become increasingly harder to solve as more miners join the network, making mining profitable only if done efficiently at scale.

Crypto mining doesn't just generate income—it also keeps blockchain networks secure, transparent, and trustworthy, laying the foundation for decentralized finance and digital currencies.

Environmental Impact of Cryptocurrency

One of the most debated topics around cryptocurrency is its environmental impact. Crypto mining, particularly for coins like Bitcoin, requires powerful computers consuming significant amounts of electricity. This energy-intensive process has raised concerns about its contribution to climate change and environmental sustainability.

Let's understand why cryptocurrency mining affects the environment:

⚡ High Energy Consumption: Crypto mining, especially Bitcoin mining, demands substantial computational power, leading to heavy electricity usage. According to the Cambridge Bitcoin Electricity Consumption Index, Bitcoin mining consumes more electricity annually than many entire countries.

🌫️ Carbon Emissions: Much of the electricity powering mining operations globally comes from fossil fuels, such as coal and natural gas, resulting in high carbon dioxide emissions that contribute to global warming.

🔊 Electronic Waste (E-waste): Mining hardware becomes obsolete rapidly due to increasing complexity, leading to frequent replacement and significant electronic waste.

However, it's essential to note that the crypto community recognizes these challenges and is actively pursuing greener solutions:

🌿 Renewable Energy: Many mining operations are moving to renewable energy sources like solar, hydro, and wind. Countries with abundant renewable energy resources, like Iceland and Norway, have become popular mining hubs.

🔄 Energy-Efficient Consensus Models: Cryptocurrencies like Ethereum have shifted from energy-intensive "Proof-of-Work" (PoW) mining to "Proof-of-Stake" (PoS). PoS dramatically reduces energy consumption by validating transactions through staking rather than complex computational work.

🔧 Technological Improvements: Hardware manufacturers continually strive for more energy-efficient mining equipment, significantly reducing energy use per mining rig over time.

Cryptocurrency mining consumes significant energy but innovations like renewable power and eco-friendly blockchain technologies are reducing its environmental footprint.

Imagine crypto mining like driving a fuel-inefficient vehicle—it gets the job done but at an environmental cost. Now, the crypto community is actively shifting to electric cars—using renewable energy and more efficient technology—to significantly lower this impact.

As crypto adoption grows, ongoing innovation and greener practices will likely minimize its environmental impact, making cryptocurrency not only financially promising but also environmentally sustainable.

Investment Opportunities for Retail Investors

Cryptocurrency has emerged as an attractive investment opportunity, particularly for retail investors—individuals investing their own money. For Pakistanis looking to diversify their investments or find high-potential returns, crypto offers multiple ways to participate, even with small amounts of capital.

Let's explore some popular crypto investment opportunities available to Pakistani retail investors:

📈 Buying and Holding (HODLing): This is the simplest and most common strategy. Investors purchase cryptocurrencies like Bitcoin or Ethereum, hoping their value will increase over time. It's similar to buying gold or stocks and holding them for future gains.

💱 Crypto Trading: More active investors trade cryptocurrencies frequently, capitalizing on short-term price fluctuations. This requires market analysis and strategic decision-making, similar to trading stocks on Pakistan Stock Exchange (PSX).

💰 Staking: Cryptocurrencies like Ethereum (ETH), Cardano (ADA), and Polkadot (DOT) offer investors the chance to earn passive income through staking—locking up crypto assets to help validate transactions on a Proof-of-Stake blockchain and earning rewards in return.

🔄 Yield Farming and DeFi: Decentralized Finance (DeFi) platforms allow investors to lend their crypto assets to others, earning interest and additional rewards. Yield farming can be very lucrative, though it carries higher risks compared to staking.

📦 Crypto ETFs and Funds: Some financial platforms offer crypto-based exchange-traded funds (ETFs) or mutual funds, providing exposure to crypto assets without directly managing them. These options are simpler, safer, and suited for more conservative investors.

Pakistani investors have multiple crypto investment opportunities—from simple holding and trading to passive income through staking and yield farming.

Think of crypto investment opportunities like a buffet: HODLing is picking your favorite dish and sticking with it; trading is tasting multiple items to find quick satisfaction; staking is like earning loyalty points for returning often; yield farming and DeFi are a bit like investing in the restaurant itself, taking on greater risk but potentially earning larger rewards.

Whatever your risk tolerance or financial goal, crypto provides accessible investment avenues, allowing Pakistani investors to grow their wealth and participate in the financial future powered by innovative blockchain technology.

Crypto Trading Platforms in Pakistan

Choosing the right crypto trading platform is crucial for safely investing in cryptocurrencies. For Pakistani investors, selecting a secure, user-friendly exchange that supports PKR deposits and offers competitive fees can significantly improve their crypto investment experience.

Here are some reliable crypto trading platforms popular among Pakistani investors:

🌐 Binance: Binance is the largest global crypto exchange, popular in Pakistan due to its wide variety of cryptocurrencies, advanced trading features, and robust security. It supports P2P (peer-to-peer) trading for PKR, allowing easy deposits and withdrawals directly via local banks and payment methods like JazzCash and EasyPaisa.

📲 OKX: Another globally recognized platform, OKX offers easy-to-use interfaces, low trading fees, and extensive educational resources. It supports multiple cryptos and also has robust P2P trading options that make transactions straightforward for Pakistani investors.

🔒 KuCoin: Known for its vast selection of altcoins, KuCoin is popular among traders looking to diversify their crypto portfolios. It provides advanced trading tools, strong security measures, and supports P2P transactions in PKR, making it accessible to Pakistani investors.

💳 Kraken: Kraken is an established exchange renowned for strong security, transparency, and ease of use, though PKR deposits aren't directly supported. Investors typically buy crypto elsewhere via P2P and transfer it to Kraken for secure storage or advanced trading.

📈 Paxful and LocalBitcoins: These are dedicated peer-to-peer exchanges where investors trade directly with each other. They allow flexible payment methods (bank transfers, cash deposits, EasyPaisa, etc.) making crypto transactions highly accessible in Pakistan.

Binance, OKX, KuCoin, Paxful, and LocalBitcoins are reliable crypto trading platforms popular among Pakistani investors, offering easy transactions in PKR and strong security.

Choosing a crypto platform is similar to choosing a reliable bank—security, ease of use, fees, and available services matter. Platforms like Binance or OKX serve like full-service banks, offering many features and flexibility. Meanwhile, Paxful or LocalBitcoins act like currency exchanges, connecting you directly with other traders for straightforward transactions.

Always remember, whichever platform you choose, ensure you follow best security practices: enable two-factor authentication (2FA), avoid sharing sensitive details, and consider secure storage options such as hardware wallets for long-term crypto holdings.

Risks and Security in Crypto Investments

While cryptocurrency offers exciting opportunities, it also comes with serious risks—especially for new investors. The crypto world is still young and not as strictly regulated as traditional finance. Understanding these risks is the first step to protecting your money and investing wisely.

Let’s break down the most common risks in crypto investing:

📉 Market Volatility: Crypto prices can rise or crash dramatically within hours. A coin worth PKR 100,000 today may drop to PKR 60,000 tomorrow. This price swing can be stressful for investors unfamiliar with such volatility.

🔐 Hacking and Cyberattacks: Crypto exchanges, wallets, and platforms can be hacked. Billions of dollars have been stolen globally. If your wallet or exchange account is compromised, there’s usually no way to recover the funds.

🎭 Scams and Rug Pulls: Many fake projects lure investors with false promises and then disappear with their money. These “rug pulls” are common in newer, lesser-known cryptocurrencies.

💾 Losing Access to Wallets: Crypto wallets require private keys or recovery phrases. If you lose this information, you may permanently lose access to your funds—there’s no “forgot password” option.

⚠️ Regulatory Risk: Some governments ban or restrict crypto trading, freezing accounts or cracking down on exchanges. Regulations in Pakistan are still unclear, so investors must tread carefully.

✅ Use two-factor authentication (2FA): Always enable 2FA on exchanges and wallets for extra login security.

✅ Choose reputable exchanges: Stick to well-known platforms like Binance or OKX, and avoid shady or unverified ones.

✅ Store assets safely: Use hardware wallets (like Ledger or Trezor) for long-term storage instead of leaving coins on exchanges.

✅ Never share private keys: Your wallet’s private key is like the PIN to your bank account—keep it secret and secure.

✅ Research before investing: Study every project before investing. If it sounds too good to be true, it probably is.

Volatility, scams, hacking, and regulation are major risks in crypto—stay secure with 2FA, strong passwords, hardware wallets, and thorough research.

Think of your crypto wallet like a digital locker. If you leave it open or share the key, anyone can walk away with your valuables. And unlike a real bank, there’s no customer service number to call if you get robbed. That’s why staying informed and cautious is the smartest way to be part of the crypto world.

With the right precautions, crypto investing can be safe and rewarding. But it’s crucial to understand that this is a high-risk, high-reward space. Never invest more than you can afford to lose.

Institutional Investors: How They Shape Crypto's Future

When cryptocurrencies first emerged, they were mostly used and traded by individual investors and early tech adopters. But over the last few years, institutional investors—large financial organizations like banks, hedge funds, mutual funds, and even tech giants—have entered the crypto space in a big way.

These institutions invest massive amounts of capital, often in the millions or billions of dollars. Their presence is shaping the future of cryptocurrency in powerful ways. Here’s how:

🏦 Legitimizing Crypto: When respected firms like BlackRock, Fidelity, or Goldman Sachs invest in Bitcoin, it sends a strong signal to the world: crypto is no longer just a niche experiment—it’s a serious asset class.

📈 Stabilizing Prices: Retail investors often cause rapid price swings due to panic buying or selling. Institutional investors typically take long-term positions, which can help reduce volatility and bring stability to the market.

🔍 Encouraging Regulation: Big institutions demand clear legal frameworks before investing. Their involvement is pushing governments and regulators (including in Pakistan) to formalize crypto policies—making the space safer for everyone.

📊 Launching Crypto Products: Institutions are creating crypto-based financial products like ETFs (Exchange-Traded Funds), crypto futures, and even Bitcoin retirement plans—making it easier for everyday investors to gain exposure without holding crypto directly.

💰 Attracting Traditional Capital: As more institutions enter the space, crypto is slowly becoming part of the mainstream financial world. Pension funds, university endowments, and insurance companies are exploring crypto as part of their portfolios.

Institutional investors are legitimizing crypto, reducing volatility, encouraging regulation, and opening the door to broader adoption globally and in Pakistan.

Think of early crypto as a startup chai dhaba—casual, exciting, and full of potential. Now imagine a big multinational company investing in that dhaba, improving quality, bringing rules, and attracting more customers. That’s what institutional investors are doing in the crypto space.

For Pakistani investors, this is good news. Institutional interest helps build trust, brings in global standards, and creates safer pathways to invest. It also signals that crypto is evolving from speculation to a more mature, long-term investment opportunity.

Potential Returns from Crypto Investments

One of the biggest reasons people are drawn to cryptocurrency is the promise of high returns. And yes, crypto has delivered eye-popping gains in the past. But it's important to understand how returns work in crypto, what’s realistic, and how to avoid being misled by hype.

🚀 Bitcoin: In 2011, 1 Bitcoin cost less than $1. By late 2021, it reached nearly $69,000. Even after its price corrections, early investors saw exponential growth—unmatched by any stock or real estate.

📈 Ethereum: Ethereum launched in 2015 at $0.75. By 2021, it crossed $4,800. It’s not just a currency but a platform powering thousands of apps and smart contracts.

💼 Altcoins: Many lesser-known coins like Solana (SOL), Cardano (ADA), and Polygon (MATIC) have also given 10x to 100x returns—though not without serious risks.

So yes, the returns can be huge. But here's the catch: prices are also highly volatile, and losses can be just as dramatic. Many retail investors have bought coins during a hype wave—only to lose 30–70% of their investment in a market dip.

Here are some smart strategies to maximize potential while reducing risk:

⏳ Long-Term Holding (HODLing): Invest in well-known coins like BTC or ETH and hold for years—just like buying property or gold for long-term growth.

📉 Buy the Dip: Don’t chase prices when they’re soaring. Wait for market corrections to buy at lower prices.

🪙 Diversify: Don't put all your money into one coin. Spread across 3–5 assets to reduce risk.

📊 Research and Patience: Study the project before investing. Stick with your plan instead of reacting emotionally to market movements.

🔁 Consider Staking: Earn passive income by staking coins like Ethereum, Cardano, or Solana instead of letting them sit idle.

Crypto can deliver extraordinary returns—but smart investors treat it like a long-term asset, backed by research, discipline, and diversification.

Think of crypto investing like planting a tree. Some trees grow fast and give fruit quickly, others take years. But if you keep digging them out every month to check the roots, none will grow. Patience, strategy, and timing are what lead to real returns.

For Pakistanis looking to grow their wealth in the digital age, crypto offers a promising—but risky—asset class. Enter with realistic expectations, proper knowledge, and a willingness to stay in for the long haul.

Why Governments Are Skeptical About Crypto

Despite its growing popularity, many governments—including Pakistan’s—remain skeptical of cryptocurrency. While the technology is powerful, its decentralized nature poses challenges for regulation, taxation, and financial control. Understanding why governments are cautious helps explain why crypto adoption isn’t yet fully mainstream.

Here are the main reasons why governments are hesitant to fully embrace crypto:

💸 Money Laundering and Illegal Use: Because crypto transactions are pseudonymous (not directly tied to real names), they can be used for illegal activities like money laundering, drug trafficking, or tax evasion. This worries governments and law enforcement agencies.

📉 Financial Instability: Cryptocurrencies are extremely volatile. If widely adopted without control, large market crashes could hurt everyday users and even affect national economies.

🏦 Threat to Central Banks: Crypto bypasses traditional banks and central financial authorities. Governments fear losing control over money supply, inflation policies, and monetary sovereignty.

🧾 Difficulty in Taxation: Tracking, reporting, and taxing crypto profits is technically challenging. Many users underreport or avoid taxes, making it hard for governments to generate revenue from this growing asset class.

👨⚖️ Lack of Consumer Protection: In traditional finance, if you’re scammed or your bank is hacked, you may recover some losses. In crypto, if you lose your wallet or fall for a scam, there's often no recourse. Governments worry about citizens being unprotected.

Governments worry about crypto enabling illegal activity, disrupting financial control, and putting everyday users at risk—driving regulatory resistance worldwide.

Think of governments like traffic police, trying to manage the flow of vehicles (money) for safety and order. Crypto is like a bunch of fast, driverless cars zooming around without asking permission. It’s powerful, but also scary without rules.

In Pakistan, the State Bank of Pakistan (SBP) has not recognized crypto as legal tender and warns citizens against using it. However, demand continues to grow, especially among youth and freelancers. The challenge now is to find a middle path where innovation is embraced without sacrificing regulation and safety.

Crypto Regulations in Pakistan

In Pakistan, cryptocurrency operates in a legal grey area. While crypto trading is not officially legal, it's also not explicitly criminalized for individuals. This lack of clarity creates confusion for investors, fintech companies, and even regulators themselves.

Here’s what we know about the current state of crypto regulation in Pakistan:

🚫 Not Recognized as Legal Tender: The State Bank of Pakistan (SBP) does not recognize any cryptocurrency as legal currency. You can’t use Bitcoin to pay for groceries or settle official bills in PKR.

📜 Circular Against Crypto (2018): In April 2018, SBP issued a circular prohibiting banks and financial institutions from processing crypto-related transactions. This stopped formal crypto exchanges from operating locally.

🧑⚖️ FIA and SECP Monitoring: The Federal Investigation Agency (FIA) has investigated fraud cases involving crypto. Meanwhile, the Securities and Exchange Commission of Pakistan (SECP) has explored crypto as a potential digital asset class—but only cautiously.

⚠️ P2P Still Active: Despite restrictions, peer-to-peer (P2P) platforms like Binance P2P, LocalBitcoins, and OKX are widely used. Traders buy/sell crypto by transferring PKR via bank accounts, JazzCash, or EasyPaisa.

🌐 Future Potential: In 2023, reports emerged that Pakistan was working on a framework to regulate virtual assets under FATF (Financial Action Task Force) guidelines. This shows an intent to eventually regulate rather than ban.

While officially discouraged by banks, crypto is widely traded via P2P platforms in Pakistan. Regulation may evolve as global pressure and local demand grow.

Think of crypto in Pakistan like rickshaws before they were formally licensed—widely used but operating without a defined set of rules. Just like rickshaws eventually got number plates and guidelines, crypto may also move toward responsible regulation in the near future.

Until then, Pakistani investors should stay cautious. Only use reputable platforms, maintain good records, and avoid large-scale trades that could trigger bank scrutiny. Once regulations arrive, those who practiced caution will be best positioned to benefit.

Common Crypto Pitfalls to Avoid

While crypto can be rewarding, it’s also full of traps—especially for beginners. Many investors lose money not because crypto is a scam, but because they fall into avoidable mistakes due to lack of knowledge, fear of missing out (FOMO), or blind trust in others.

Here’s a list of the most common crypto pitfalls—and how you can avoid them:

📈 Buying the Hype: Many new investors buy coins when prices are peaking—usually driven by hype on social media. By the time they enter, the early investors are already selling. This often results in buying high and selling low.

💸 Investing More Than You Can Afford to Lose: Crypto is volatile. Never invest your rent money or emergency savings. Only invest what you can afford to lose without affecting your day-to-day life.

🔍 Blindly Following Influencers: Many social media influencers promote “next big coins,” often because they are paid to. Always do your own research (DYOR) instead of copying others’ trades.

🔐 Ignoring Security: Using weak passwords, ignoring 2FA, or storing coins on unsafe platforms can lead to permanent loss. Always prioritize wallet and account security.

🧾 No Record Keeping: Many users don’t track their buys, sells, and profits. Later, they get confused about taxes or total gains/losses. Keep simple records of your trades—even if it's in an Excel sheet or notes app.

🎲 Falling for Get-Rich-Quick Scams: If someone promises to double your money or offers “guaranteed” profits—it’s likely a scam. There are no guaranteed returns in crypto or any real investment.

📉 Panic Selling During Dips: Markets go up and down. Selling during temporary crashes often locks in losses. Patience is key—especially if you’re investing in solid projects.

🔄 Overtrading: Constantly buying and selling on emotion can lead to losses due to fees and poor timing. Avoid making decisions based on panic or excitement.

Avoid hype-driven investing, scams, panic selling, poor security, and blind trust—these are the most common ways crypto investors lose money.

Think of crypto like planting a tree. It needs the right soil (research), protection (security), patience (holding through dips), and care (learning). But if you pull it out every week or throw it in rocky soil, it won’t grow.

Crypto rewards those who are careful, patient, and informed. If you’re starting your journey in Pakistan, treat crypto like a serious investment—not a lottery ticket—and you’ll already be ahead of most new investors.

Conclusion — Is Crypto the Future?

Cryptocurrency is more than just an internet trend or a get-rich-quick scheme. It’s a revolutionary idea backed by cutting-edge technology that’s challenging how we think about money, ownership, and trust. After reading this guide, you should now have a solid understanding of what crypto is, how it works, and why it matters.

To recap: cryptocurrency is a form of digital money that doesn’t need banks or governments to work. Instead, it uses a secure, public, and decentralized system called the blockchain. Every transaction is verified by a network of computers (or miners) and recorded permanently. This makes crypto transparent, secure, and free from centralized control.

We explored how crypto compares with traditional fiat money—highlighting faster global transactions, lower fees, and inflation resistance. We saw how mining powers the network, how institutional investors are shaping its future, and how Pakistani users are already participating through peer-to-peer platforms.

But we also saw the other side: crypto is risky. Prices can swing wildly. Scams are common. And regulation—especially in Pakistan—is still catching up. That’s why understanding the risks, security practices, and common pitfalls is just as important as understanding how crypto can make you money.

If you’ve heard terms like staking, yield farming, or DeFi (Decentralized Finance) and felt confused—don’t worry. These are advanced crypto strategies that let you earn passive income or participate in an alternative financial system without banks. We only touched on them briefly in this guide, but in upcoming posts on AasaanFinance, we’ll break them down step-by-step in Urdu-friendly, Pakistan-specific language.

Think of crypto like the early days of the internet. At first, only techies and hobbyists used it. Then came businesses. Now, it’s part of everyday life. Crypto is on a similar path—still early, still evolving—but clearly here to stay.

For Pakistanis, crypto offers an opportunity. It’s a way to hedge against inflation, access global finance, and even earn a living online. But only if approached with knowledge, caution, and discipline.

Crypto isn’t just a new kind of money—it’s a new way to think about trust, ownership, and freedom. And this is just the beginning.

So what should you do now? Stay curious. Keep learning. Start small. Don’t fall for hype. Protect your wallet. And follow AasaanFinance as we continue to break down more crypto topics—whether it’s how to earn with staking, explore DeFi platforms, or understand future laws and taxes in Pakistan.

Crypto is the future—but only for those who take the time to understand it. And now, you’ve already taken the first big step. 🚀