📘 Contents

What Are Stocks?

Stocks — also known as shares or equities — represent ownership in a company. But let’s not stop there, because this single sentence hides a powerful idea that fuels economies, builds fortunes, and gives people like you and me a chance to grow wealth alongside the world's biggest businesses.

A stock is a piece of a company you can buy. It makes you a partial owner, giving you a share in its profits — and its future.

When a company wants to grow — build factories, hire talent, expand into new markets — it often needs more money than it currently has. One way to raise this money is by issuing stocks to the public. In return, investors (people like you) who buy these stocks become partial owners of the business.

Think of it like this: imagine a company is a giant pizza. Each slice of the pizza is a share. When you buy one slice, you're entitled to enjoy part of whatever that pizza earns — be it profits (through dividends), or future value (if the pizza grows in size and quality over time). The more slices you own, the bigger your voice and share in the company.

This isn’t limited to billionaires or financial wizards. Today, anyone with a smartphone and a little knowledge can become a shareholder in companies like Microsoft, Apple, Unilever, or even local firms listed on the Pakistan Stock Exchange like Meezan Bank, Engro, or Lucky Cement.

In essence, buying a stock gives you a seat at the table of businesses — from startups to multinationals — and ties your financial future to their performance. When they win, you win. When they struggle, you share that risk too.

Stocks are the building blocks of modern investing. To understand wealth creation, economic growth, and even global politics — you need to understand what stocks are, how they work, and why they matter.

Let’s dive deeper, layer by layer — and turn this powerful concept into something you can fully understand, use, and grow from — no matter your age, background, or financial status.

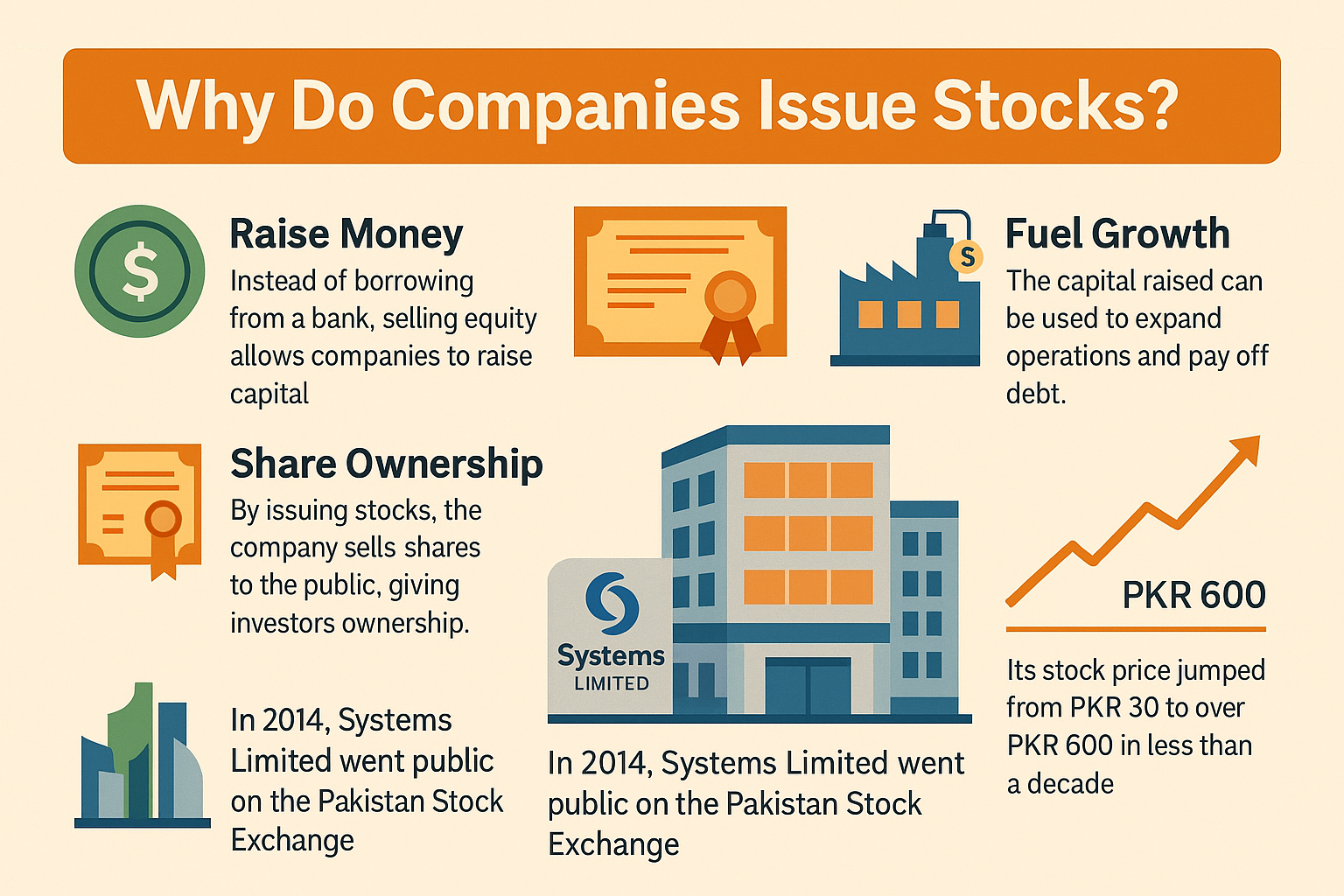

Why Do Companies Issue Stocks?

Companies issue stocks to raise money. It’s that simple. Instead of borrowing from a bank — and paying back with interest — they can raise capital by offering the public a chance to buy equity in their business.

Companies issue stocks to raise capital without debt — giving the public a stake in their future. This fuels growth, innovation, and shared success between businesses and investors

The word equity simply means ownership. When a company sells equity, it’s giving up a portion of ownership in exchange for money. In return, the people who buy that equity — the shareholders — become part-owners of the company. These ownership units are what we call stocks or shares.

By issuing equity, the company doesn’t have to pay back any loan. Instead, it gets to use the raised money to grow — build factories, launch new products, expand operations, or even pay off old debts — while giving investors a chance to benefit from that growth.

A great real-life example is Systems Limited, one of Pakistan’s leading IT companies. When it went public on the Pakistan Stock Exchange in 2014, it sold equity to the public and raised new funds. That move helped the company scale up, expand internationally, and build trust with clients worldwide.

For investors, it was a golden opportunity. Shares that were originally priced around PKR 30 have soared past PKR 600 in less than a decade — delivering massive returns. This shows how a company’s growth, funded through equity, can reward both the business and its shareholders.

So when a company issues stocks, it’s not just raising money — it’s sharing its future. The business gets the fuel it needs, and the public gets a seat on the ride. That’s the power of equity.

What Happens When You Buy a Stock?

So, you’ve decided to buy a stock — maybe it’s a tech company you believe in, a cement giant you’ve heard about, or a bank you use every day. What actually happens when you tap that “Buy” button on your phone or ask your broker to place the order?

In that moment, you’re buying a tiny ownership stake in the company. You now hold a share — or more — of that business. It doesn’t matter if you bought one share out of millions; you're still legally a part-owner of that company.

This ownership gives you certain rights and opportunities:

You’re entitled to a portion of the company’s profits (if they choose to share them — more on this in the next section).

You benefit if the value of the company goes up — because the stock price typically rises with it.

- You can vote in important decisions (for some types of stocks).

Let’s say you buy 100 shares of Engro Corporation. You didn’t just buy a digital receipt — you bought a piece of one of Pakistan’s largest conglomerates. When Engro performs well, earns profits, or pays out dividends, you benefit. If the stock price goes from PKR 250 to PKR 300, your holding increases in value by 20%. And if they announce a cash dividend of PKR 10 per share, you receive PKR 1,000 — straight into your brokerage account.

Of course, owning stock also means taking on risk. If the company struggles, the share price can fall. Stocks don’t guarantee returns — they offer opportunity, but they also involve uncertainty.

Buying a stock is like planting a seed in a company’s garden. You don’t control the weather or the soil, but if the company grows and thrives — you get to enjoy the fruit.

How Do Stocks Make You Money?

Owning a stock isn’t just about having a piece of a company — it’s about growing your wealth over time. But how exactly does that happen? There are two main ways stocks make you money:

Stocks grow your wealth in two powerful ways: by rising in value over time (capital gains) and by paying you a share of profits (dividends) — making your money work even while you sleep.

This is the most common and exciting way people make money in the stock market. If the value of the company increases — through higher sales, better profits, or future growth potential — the stock price rises. If you bought the stock at a lower price and sell it at a higher price, the difference is your profit.

For example, if you buy 100 shares of a company at PKR 50 per share, and a few months later the price rises to PKR 70, you can sell those shares for a total of PKR 7,000. Since you only paid PKR 5,000, you’ve made a PKR 2,000 profit, just by holding the stock.

Some companies choose to share a portion of their profits with shareholders. This is called a dividend. It’s usually paid out in cash — directly into your account — based on how many shares you own. Think of it as a reward for supporting the company and staying invested.

For example, if a company announces a cash dividend of PKR 5 per share and you own 300 shares, you’ll receive:

300 shares × PKR 5 = PKR 1,500 — without needing to sell

anything.

But here’s something many new investors don’t know: when a company pays a dividend, the stock price often adjusts on the ex-dividend date. On that day, the stock usually drops by roughly the amount of the dividend. Why? Because the value of the company has now decreased by the cash it’s paying out.

Let’s say a stock was trading at PKR 120 and the company announces a PKR 5 dividend. On the ex-dividend date, the price may drop to around PKR 115. You haven’t lost money — that PKR 5 has simply moved from your stock value into your hands as a cash dividend. So the total value of your investment stays nearly the same.

Now let’s walk through a real example. Suppose you invested in Meezan Bank in 2020, buying 500 shares at around PKR 60 per share. Your total investment would be:

500 × 60 = PKR 30,000Over the next few years, Meezan’s share price gradually rose to over PKR 150. At that price, your holding would now be worth:

500 × 150 = PKR 75,000But that’s not all. Suppose Meezan paid an average dividend of PKR 5 per share annually. Over 4 years, you would’ve earned:

500 × 5 × 4 = PKR 10,000 in cash dividendsSo your total return isn’t just a stock price gain of PKR 45,000 — it also includes PKR 10,000 in passive income. That’s the power of stocks: they can grow in value and pay you while you wait.

Dividends may seem small at first, but over time they can become a significant income stream — especially if reinvested. In fact, many of the world’s wealthiest investors attribute a large part of their success to compounding dividends.

What Really Moves a Stock’s Price?

Stock prices don’t move randomly. Behind every jump or drop in a stock chart, there are real reasons — and they often have less to do with just numbers, and more to do with how people think, feel, and react. Understanding this is key to becoming a confident investor.

Stock prices don’t just follow numbers — they follow human behavior, expectations, and patterns. This infographic breaks it down into three simple forces: fundamentals, technicals, and psychology — the real engine, waves, and weather behind every price move.

At the core, a stock’s price is driven by one powerful force: supply and demand. If more people want to buy a stock (demand) than sell it (supply), the price goes up. If more people want to sell than buy, the price goes down. Simple — but what causes that buying or selling? That’s where it gets interesting.

This includes everything from sales, profits, debt levels, future growth plans, and market position. If a company shows strong results — like higher quarterly earnings, new product launches, or a big export deal — investors feel confident, and demand for its stock rises, pushing the price up. Weak financials or scandals do the opposite.

Many investors study price charts to spot patterns, trends, and key levels like support and resistance. Even though technical analysis doesn’t focus on the company itself, it reflects how other investors are behaving. When a stock breaks above a past high, it may trigger excitement (called a breakout). If it falls below a key level, panic selling can follow.

Markets are driven by human emotion. Sometimes stocks rise just because everyone believes they will — and they fall because everyone panics. If investors feel optimistic about the economy or a sector, they buy. If there's fear (like during political instability or inflation scares), they sell — even if the company is doing fine. This is why good stocks sometimes fall, and bad ones sometimes rise.

Picture a stock like a boat on water. Fundamentals are the engine, technicals are the waves, and psychology is the weather. Sometimes the engine is strong, but rough waves or a sudden storm (bad news or fear) can rock the boat.

For example, a fundamentally strong company like Lucky Cement might fall in price if political tension creates fear across the entire market. At the same time, a weak stock might rise for a few days simply because social media hype triggered a rush of buyers. This is why experienced investors look at all three forces before making a decision — not just charts, and not just numbers.

In the end, stock prices move because of people — their expectations, emotions, beliefs, and behaviors. The more you understand these forces, the less you’ll panic when prices move, and the better your investing decisions will be.

What Are the Risks of Investing in Stocks?

Stocks can build wealth — but they can also shrink it. As powerful as stocks are for long-term growth, they come with risks that every investor must understand before putting money in. The more realistic your expectations, the smarter your decisions will be.

Stocks offer growth — but not without risks. From market swings and poor company decisions to emotional panic and low liquidity, understanding these challenges is key to smart, long-term investing.

Stock prices rise — but they also fall. Sometimes it’s because of company-specific news, and sometimes it’s due to broader economic events like inflation, political instability, or global recessions. Even strong companies see their stock prices drop in rough times. If you panic and sell during a dip, you lock in losses.

For example, in 2022, the Pakistan Stock Exchange fell sharply amid political uncertainty. Even good companies like HBL and MCB saw their stock prices decline — not because they were doing poorly, but because overall investor sentiment was shaken.

Just because a company is listed on the stock exchange doesn’t guarantee it will succeed. Businesses can make poor decisions, face unexpected competition, or mismanage their finances. If a company’s performance declines long-term, its stock price may never recover.

Take the case of K-Electric. At one point, it was one of the most talked-about stocks due to privatization and expected reforms. But due to regulatory issues, stalled tariffs, and poor investor communication, the stock remained stagnant or fell for years — frustrating many who bought in on hype.

Many people lose money not because the company failed — but because they couldn’t control their emotions. Fear makes you sell too early. Greed makes you hold too long. Impatience pushes you to chase risky stocks or try to time the market. Successful investing isn’t just about numbers — it’s about managing your mindset.

Some stocks on the Pakistan Stock Exchange are thinly traded — meaning very few people buy or sell them daily. If you want to exit your position, you might not find a buyer easily, or you may be forced to sell at a lower price.

Unlike a fixed deposit or a government bond, stocks don’t promise you any fixed return. Dividends can be skipped. Prices can fall. Even if you hold for years, returns are not guaranteed — they depend on the company’s performance and market conditions.

That said, most of these risks can be managed — with patience, research, diversification, and a long-term mindset. Investing blindly is risky. But investing wisely is empowering.

The goal is not to avoid risk — it's to understand it. Because in the stock market, knowledge is your real safety net.

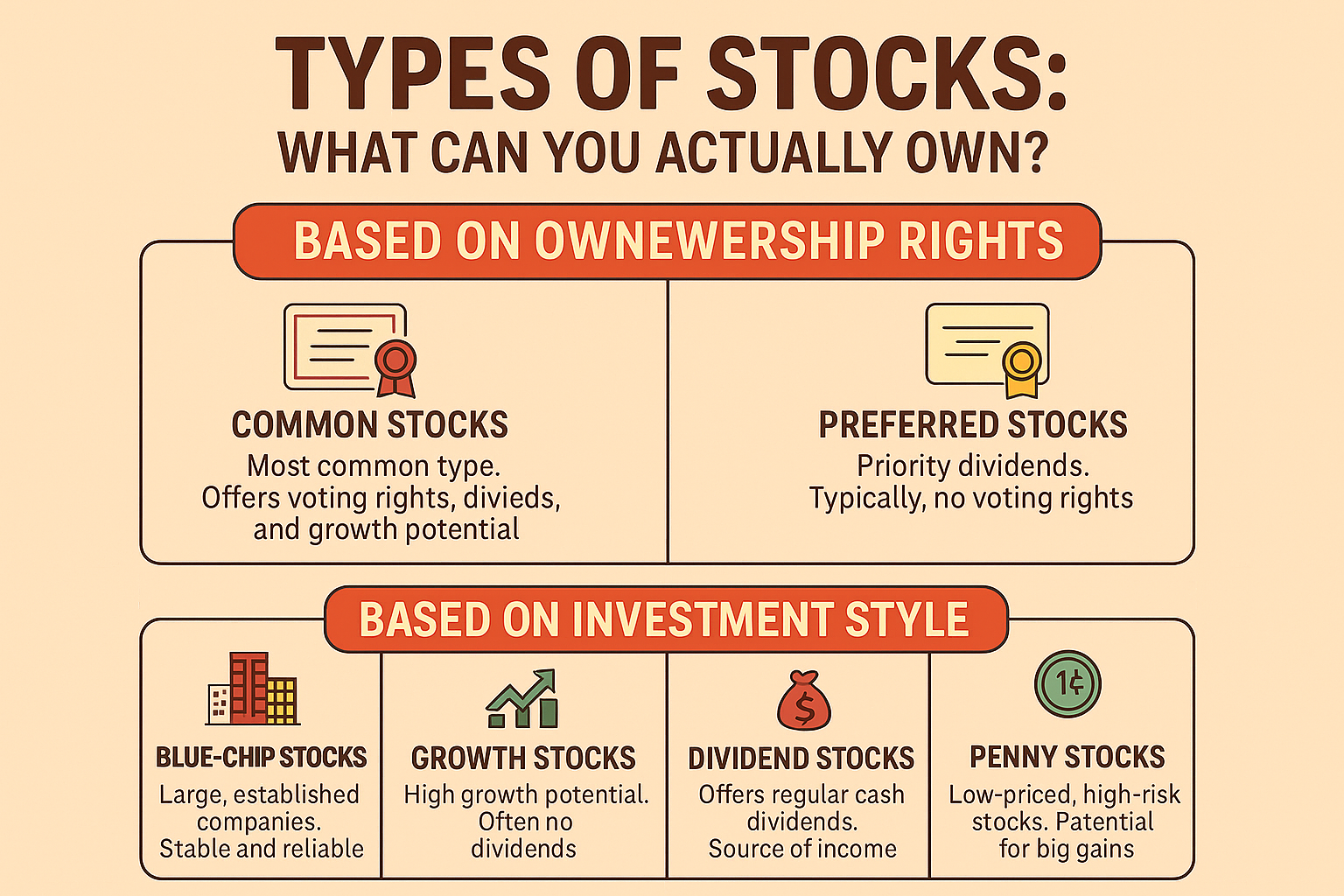

Types of Stocks: What Can You Actually Own?

Not all stocks are the same. Just like there are different types of cars — economy, luxury, SUV, electric — stocks also come in different categories, based on what they offer and how they behave. Understanding these types helps you build a smarter portfolio.

From blue-chip giants to high-risk penny stocks — this guide breaks down the main types of stocks every investor should know.

Common Stocks: This is what most people buy. You get ownership, voting rights (in some cases), and the chance to earn from dividends and price increases. But if the company goes bankrupt, you're last in line to get paid.

Preferred Stocks: Less common for everyday investors. These don’t usually come with voting rights, but they offer fixed dividend payments and priority over common shareholders in case of liquidation. They act more like a mix of stocks and bonds.

Blue-Chip Stocks: Big, established, and reliable companies with a history of stable performance. Think Engro, MCB, Lucky Cement, or Meezan Bank. These are great for long-term, low-stress investing.

Growth Stocks: These are companies expected to grow faster than average. They often reinvest profits instead of paying dividends. In Pakistan, tech firms like Systems Limited or TPL Trakker may fall into this category.

Dividend Stocks: Stocks known for paying regular cash dividends. Ideal for those looking for passive income. Examples include Hub Power Company or United Bank Limited.

Penny Stocks: Low-priced stocks (often under PKR 10–15) with small market caps and high risk. These can deliver huge gains — or massive losses. Invest here only if you understand the risk and can afford the loss.

Most Pakistani investors start with blue-chip and dividend-paying stocks — they’re easier to trust, easier to understand, and less volatile than penny or speculative stocks.

As you grow in confidence and experience, you can explore a mix of stock types to match your goals — whether it’s safety, growth, or income.

Where and How to Buy Stocks in Pakistan

Getting started with investing in the Pakistan Stock Exchange (PSX) is easier than ever. Here’s a step-by-step guide to help you open your first stock trading account and begin your journey as an investor.

This infographic shows a beginner-friendly roadmap to start investing in the Pakistan Stock Exchange — from choosing a licensed broker to placing your first trade.

Step 1: Choose a SECP-licensed brokerage.

To buy or sell shares, you need to open an account with a brokerage firm registered with the Securities and Exchange Commission of Pakistan (SECP).

Step 2: Open a CDC investor account.

The Central Depository Company (CDC) holds your shares electronically. Most brokerages will help you open this account during the registration process.

Step 3: Fund your account.

Transfer money from your bank account into your brokerage account to start trading. Online and mobile banking are usually supported.

Step 4: Start trading.

Use the brokerage’s mobile app or desktop portal to place buy or sell orders, monitor stock prices, and track your portfolio.

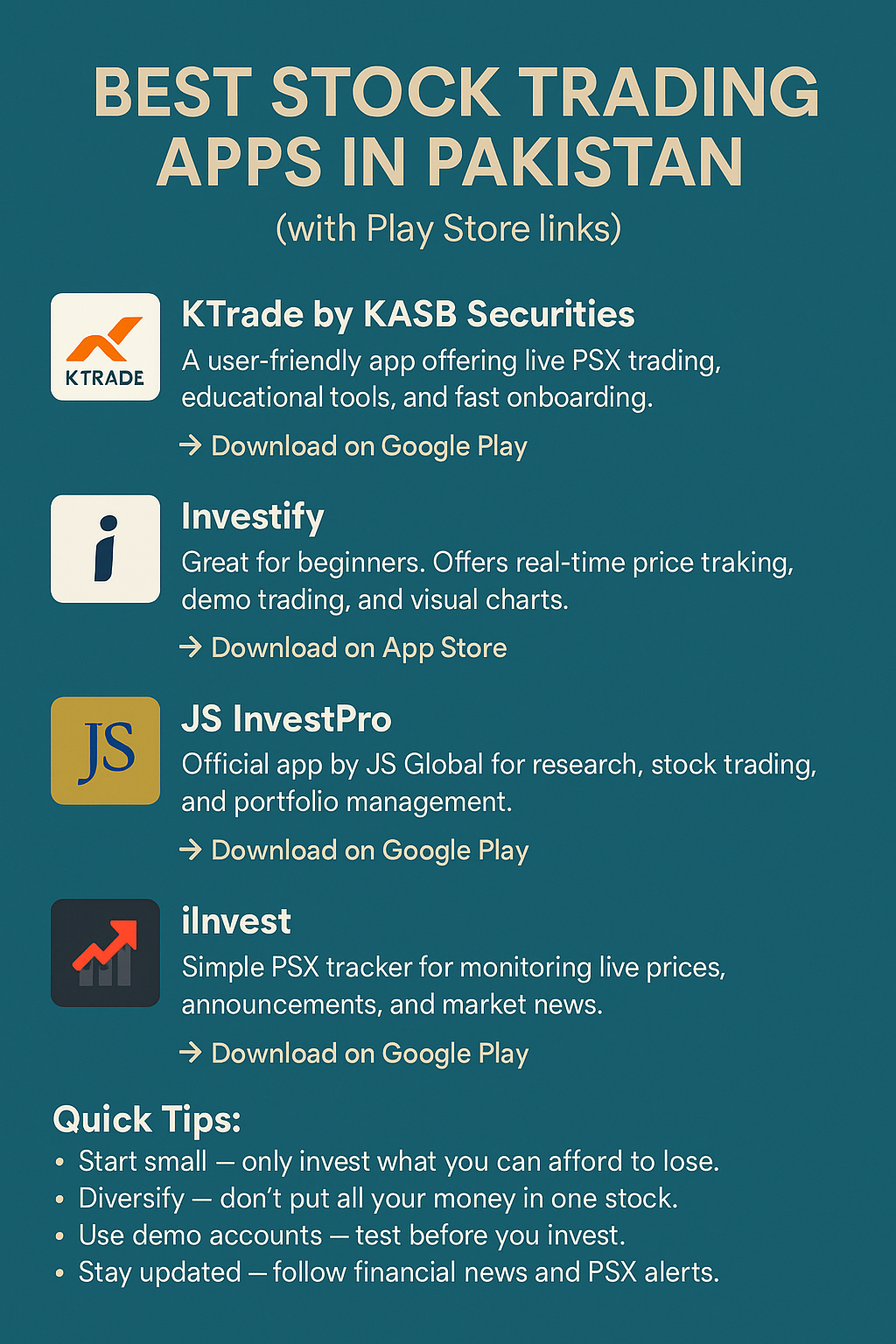

Best Stock Trading Apps in Pakistan (with Play Store links)

A handy visual guide to Pakistan’s top stock trading apps — highlighting features, platforms, and beginner-friendly tips to help you get started confidently.

These apps are trusted by Pakistani investors for real-time PSX access:

1. KTrade by KASB Securities

A user-friendly app offering live PSX trading, educational tools, and fast onboarding.

👉 Download on Google Play

2. Investify

Great for beginners. Offers real-time price tracking, demo trading, and visual charts.

👉 Download on Google Play

3. JS InvestPro

Official app by JS Global for research, stock trading, and portfolio management.

👉 Download on App Store

4. iInvest

Simple PSX tracker for monitoring live prices, announcements, and market news.

👉 Download on Google Play

Quick Tips:

• Start small — only invest what you can afford to lose.

• Diversify — don’t put all your money in one stock.

• Use demo accounts — test before you invest.

• Stay updated — follow financial news and PSX alerts.

Once you're set up, you can start buying shares of real Pakistani companies and slowly grow your wealth through informed investing.

Taxes, Real Returns & the Hidden Cost of Doing Nothing

Making money from stocks is exciting — but how much of it do you actually keep? After all, there are two things that quietly eat into your profits: taxes and inflation.

This infographic reveals how taxes and inflation impact your investment returns — and why sitting on cash can silently shrink your wealth over time.

Let’s go back to our earlier example: you bought 500 shares of Meezan Bank in 2020 at PKR 60 each. That’s a PKR 30,000 investment.

By 2024, the stock rises to PKR 150. You now have PKR 75,000 worth of shares — a capital gain of PKR 45,000. You also received an average dividend of PKR 5 per share for 4 years:

500 × 5 × 4 = PKR 10,000So your total gain is:

PKR 45,000 (gain) + PKR 10,000 (dividends) = PKR 55,000Now apply taxes:

- Capital Gains Tax (CGT): 15% of PKR 45,000 = PKR 6,750

- Dividend Tax: 15% of PKR 10,000 = PKR 1,500

Now let’s talk about inflation. From 2020 to 2024, average inflation in Pakistan hovered around 20% per year. That means:

PKR 30,000 in 2020 ≈ PKR 62,000 in 2024 termsEven after inflation, your stock investment grew beyond that — ending up around PKR 75,000. And you collected real cash dividends on top.

Now compare this with someone who kept PKR 30,000 in cash or a basic savings account. After 4 years, that money would barely buy what PKR 15,000 could in 2020. In other words, they got poorer without even realizing it.

This is why investing isn’t optional anymore — it’s essential. You don’t invest to get rich overnight. You invest to protect your money from silently shrinking — and to give it a chance to grow.

Conclusion — Why Stocks Deserve Your Attention

Stocks aren’t just assets — they’re opportunities. Start small, stay consistent, and let your money grow with purpose.

In this guide, we explored what stocks are, why companies issue them, how investors make money, what drives stock prices, the risks involved, the impact of taxes and inflation — and most importantly, how to get started in Pakistan.

Yes, stocks carry risk. But so does doing nothing. Leaving your money in cash while inflation eats away at it is also a risk — just one that feels quieter. Over time, the stock market has proven to be one of the most powerful ways to build long-term wealth, even in uncertain economies like ours.

You don’t need to be rich to invest. You don’t need a finance degree. You just need to start small, stay consistent, and keep learning.

So whether you’re 18 or 58 — the best time to start investing was yesterday. The second-best time is right now.

This isn’t just a guide. It’s a starting line. Welcome to the world of stocks — where your money can finally work for you.