📘 Contents

What Are Mutual Funds?

Imagine you and a group of friends want to buy a whole cow, but each of you only has enough money for a leg or a tail. So you all pool your money together and buy the whole cow — and then share the benefits. That’s exactly what a mutual fund does — but instead of buying a cow, you're buying a basket of investments like stocks, bonds, or sukuk.

Mutual funds are like buying a cow together — you pool money with others to own a diversified basket of investments, even if you can’t afford the whole thing alone.

A mutual fund is a professionally managed investment fund that collects money from multiple investors and invests it in a diversified portfolio. You don’t need to pick individual stocks or time the market. A professional fund manager does all the buying, selling, and decision-making for you.

So even if you invest just PKR 500 or 5,000 — you get exposure to a whole portfolio of investments you wouldn’t afford or manage on your own.

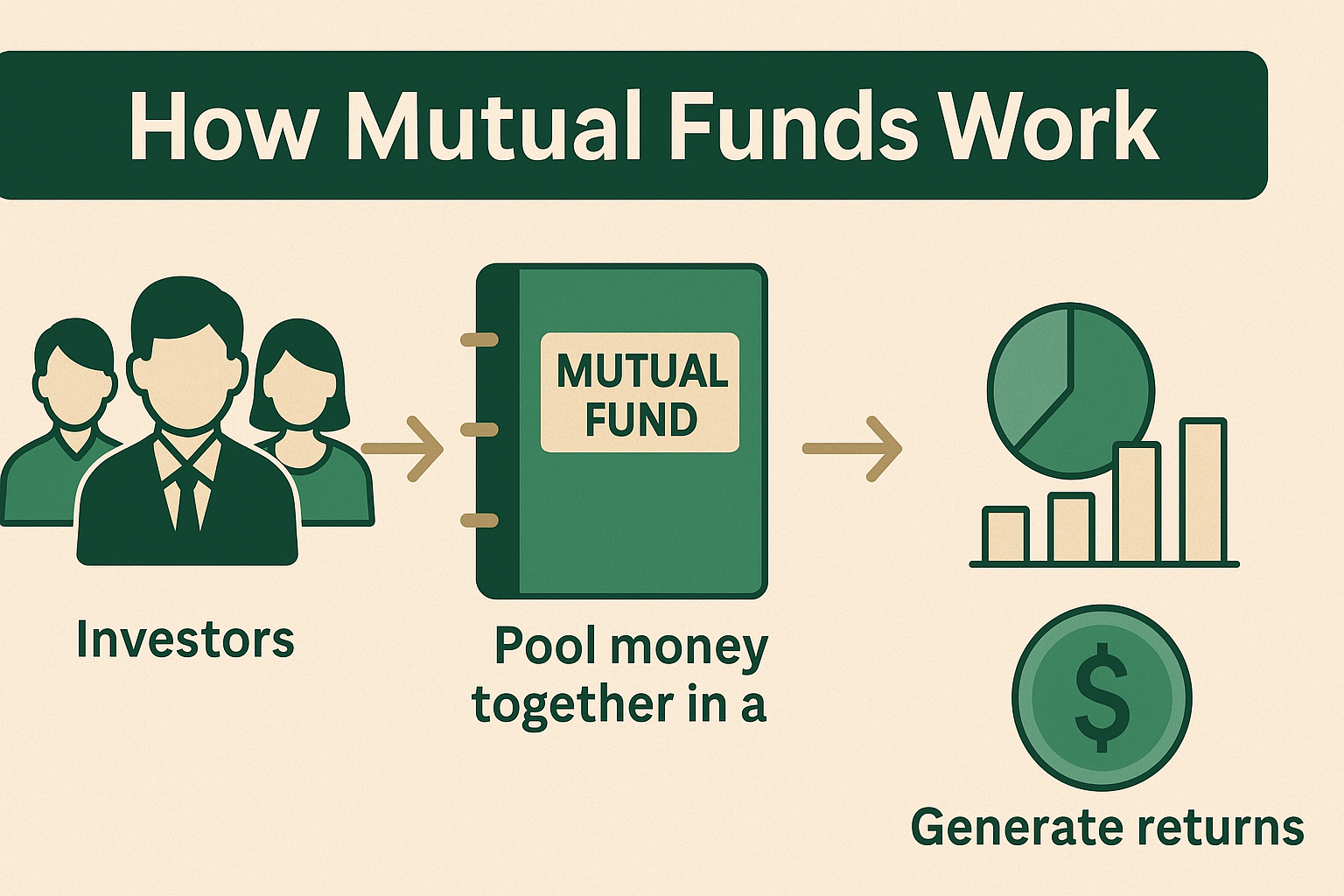

How Do Mutual Funds Work?

Here’s a simple breakdown of how mutual funds operate:

- 1. You invest money: You buy "units" of the mutual fund. Each unit represents your share in the fund.

- 2. Fund pools money: The fund collects money from thousands of investors like you.

- 3. Fund manager invests: A qualified fund manager decides where to invest this money — e.g. in company stocks, government bonds, real estate, etc.

- 4. Fund earns returns: When those investments grow (via price increase, dividends, or interest), the value of your units increases too.

- 5. You redeem anytime: You can sell your units anytime and withdraw your money (after charges or taxes, if applicable).

You invest in a fund, the fund invests in assets, and professional managers handle the rest — giving you access to diversified investments without the stress.

Think of it like booking a seat on a bus: you don’t drive, but you’re still headed toward the destination. The fund manager is your driver.

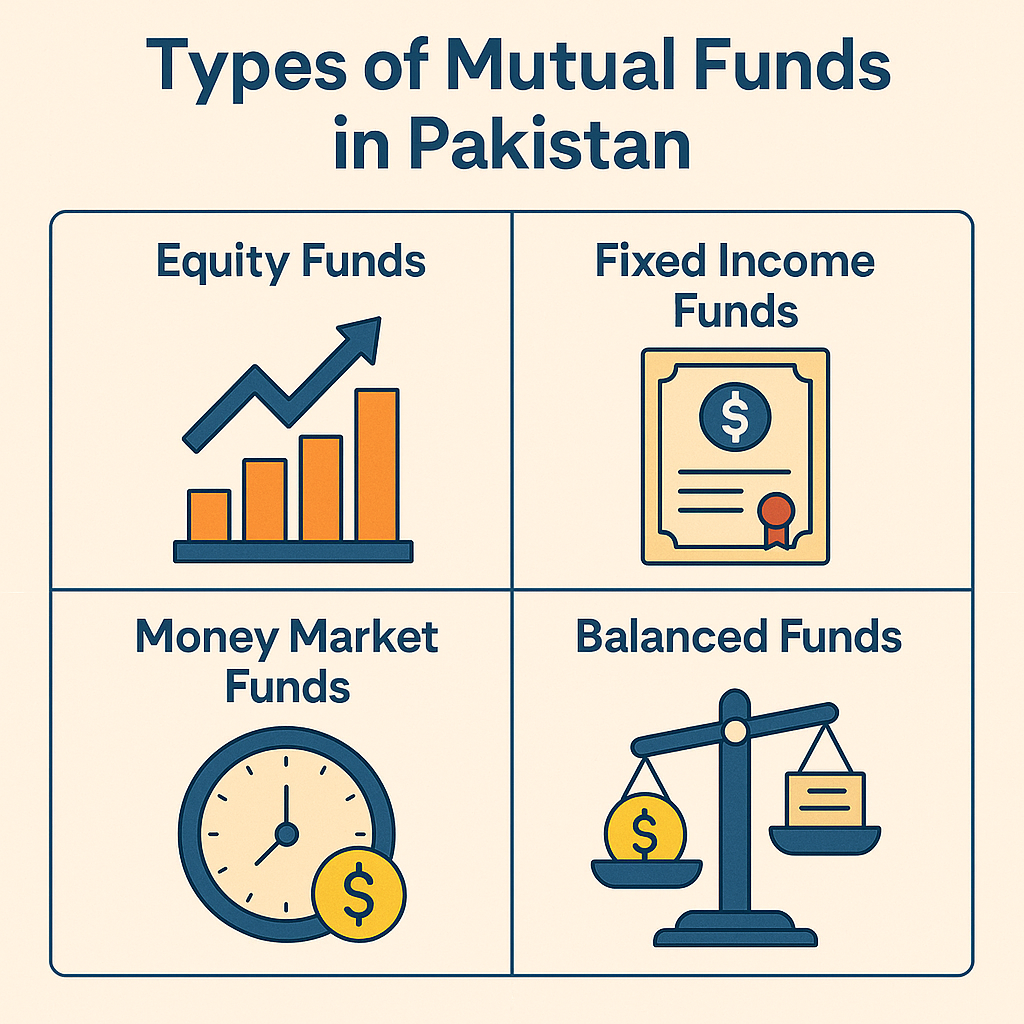

Types of Mutual Funds in Pakistan

Mutual funds come in different flavors, depending on what they invest in and what kind of return (or risk) they offer:

- Equity Funds: Invest mostly in stocks. Higher risk, higher potential return.

- Income Funds: Invest in fixed-income securities (like T-Bills or Sukuk). Lower risk, more stable returns.

- Money Market Funds: Short-term investments, ideal for very low-risk and quick liquidity.

- Balanced Funds: A mix of both stocks and fixed income. A good compromise between risk and return.

- Islamic/Shariah-Compliant Funds: Follow Islamic principles and avoid interest or haram businesses.

From income and balanced to Islamic and equity funds — Pakistan offers mutual fund types tailored to every risk level and financial goal.

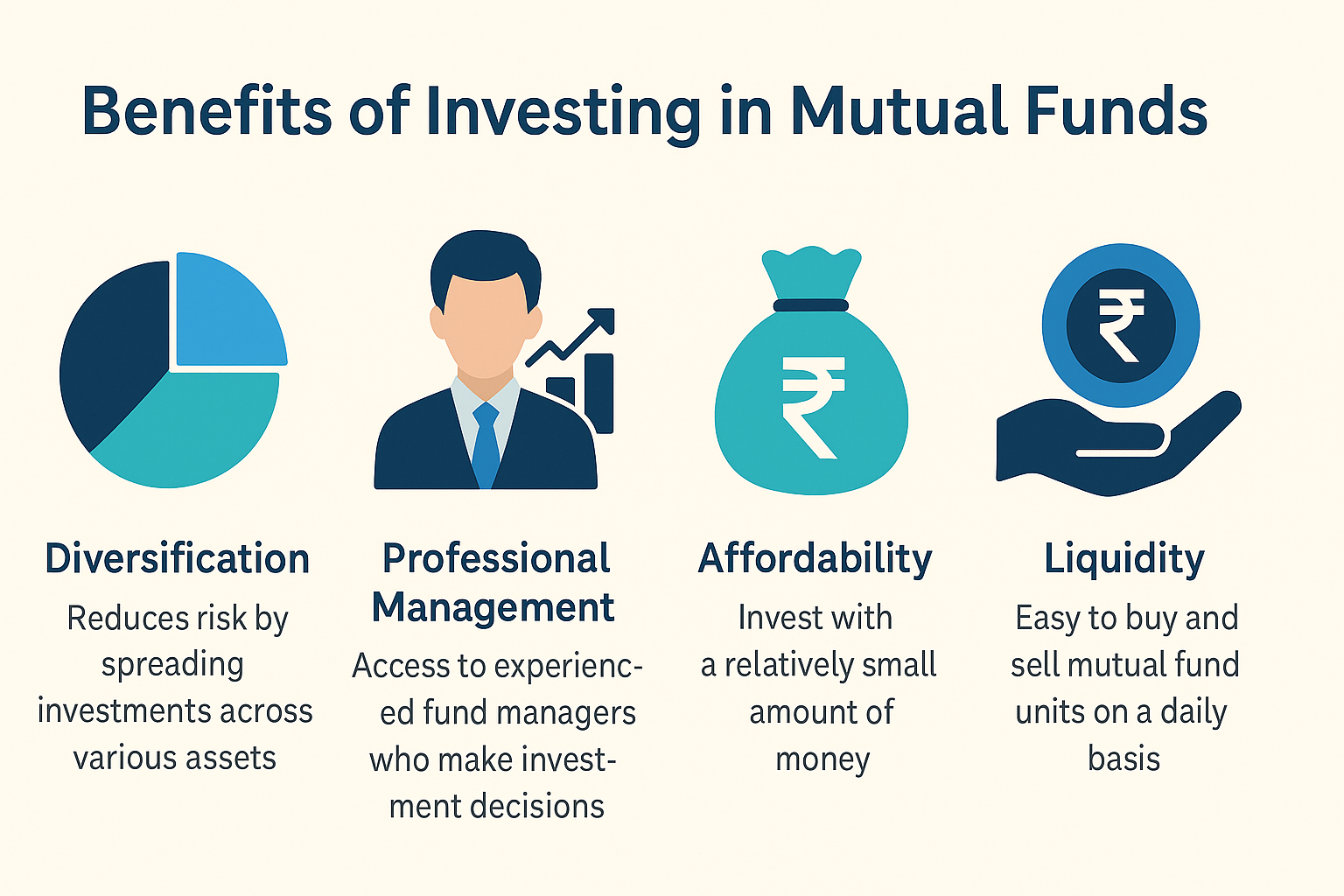

Benefits of Mutual Funds

Here’s why mutual funds are a great choice — especially for beginners:

- ✅ Easy to start: You can start with as little as PKR 500 in some funds.

- ✅ Professional management: Experts make decisions so you don’t have to track markets daily.

- ✅ Diversification: Your money is spread across many investments, reducing risk.

- ✅ Liquidity: You can exit anytime (except some locked funds).

- ✅ Regulated: Funds in Pakistan are regulated by SECP for investor protection.

Mutual funds offer diversification, expert management, affordability, and ease — helping you grow your wealth steadily, even with small amounts.

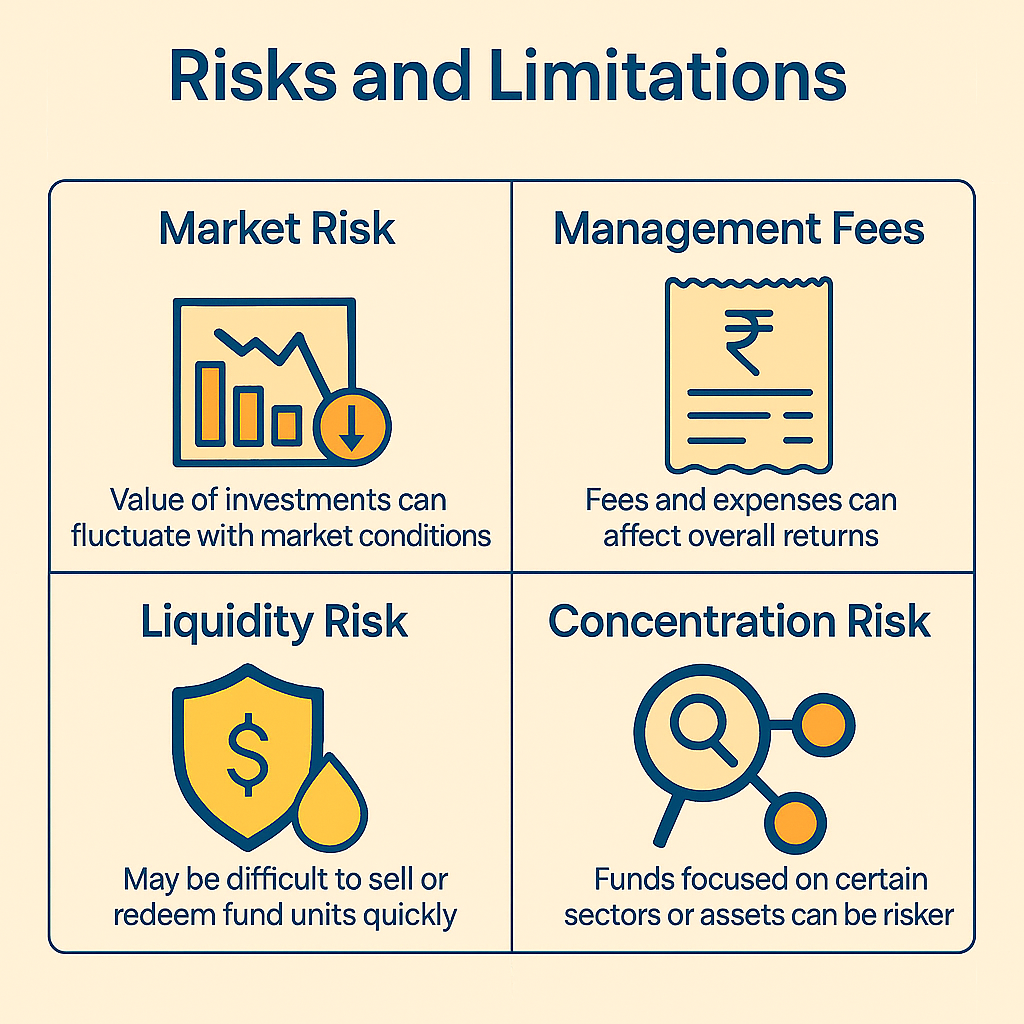

Risks and Limitations

While mutual funds are safer than picking individual stocks, they’re not completely risk-free:

📉 Market risk: If the market drops, your fund may lose value.

💸 Management fee: Every fund charges a management fee (typically 1–2%), which eats into your return.

⏳ No guaranteed return: Even with professionals managing it, returns are never fixed.

🧾 Capital gains tax: You pay tax on profits when you sell.

Every investment carries risks. Understand market fluctuations, management fees, and liquidity issues before diving into mutual funds.

Major Asset Management Companies (AMCs)

In Pakistan, mutual funds are managed by licensed Asset Management Companies (AMCs). Here are some of the leading ones:

UBL Fund Managers – Offers both Islamic and conventional funds.

HBL Asset Management – Popular for income and balanced funds.

Al Meezan Investment – Pakistan’s largest Shariah-compliant fund manager.

MCB Arif Habib – One of the oldest and most trusted AMCs.

Askari Investment Management – Offers military-friendly plans.

Faysal Asset Management – Known for fixed-income products.

Explore trusted asset management companies like HBL, MCB Arif Habib, and NBP Fund — the driving forces behind Pakistan’s mutual fund industry.

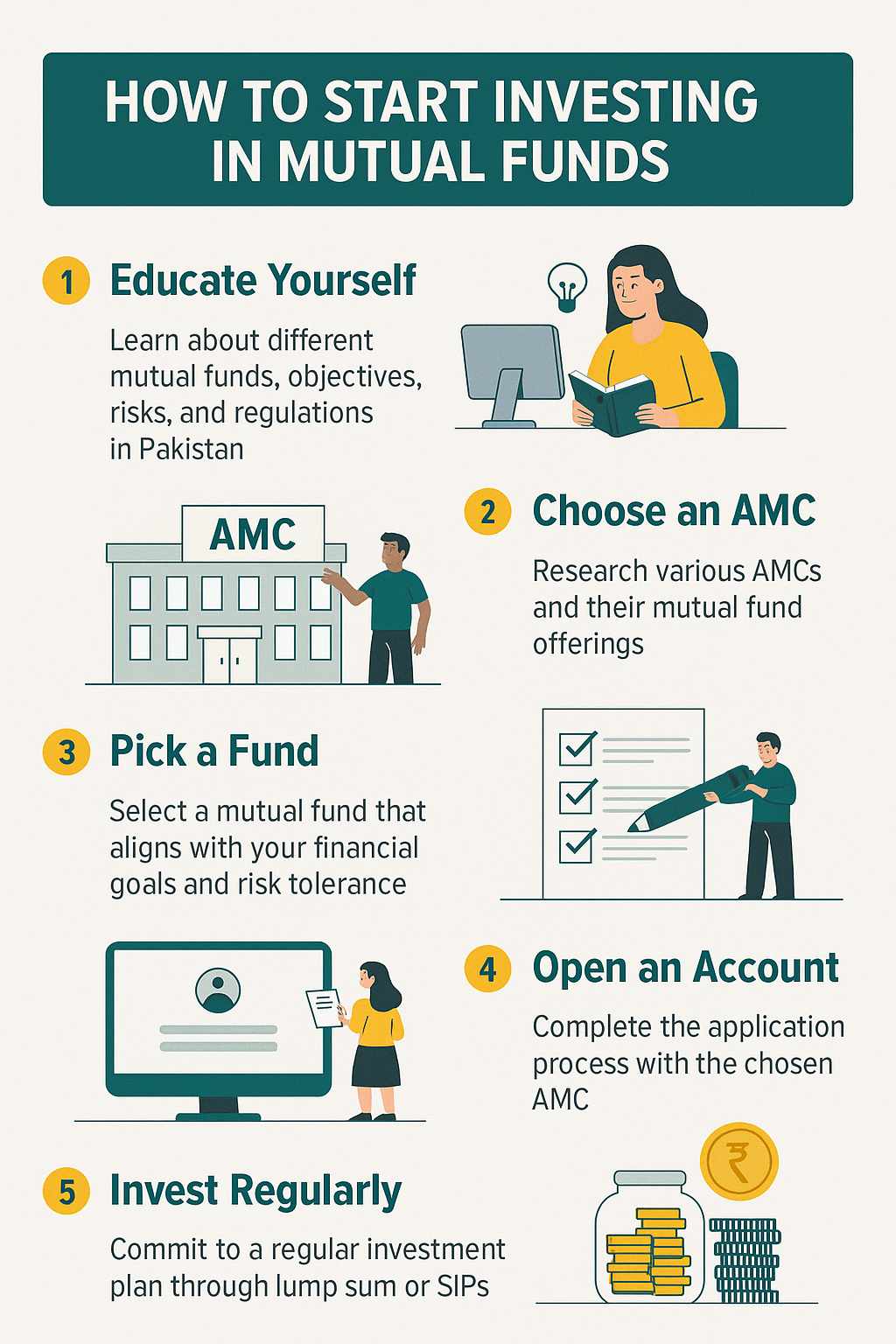

How to Start Investing in Mutual Funds in Pakistan

Getting started is now easier than ever. Here’s a simple step-by-step:

1. Choose an AMC: Visit their website or app. Compare their funds, performance, and fees.

2. Register and open an account: You’ll need CNIC, bank account, and income info.

3. Pick your fund: Equity, Islamic, money market — based on your risk level.

4. Invest online: Use mobile apps or transfer directly from your bank.

5. Track performance: You’ll get daily NAV updates and annual reports.

Open an account, complete KYC, select a fund, and start with as low as PKR 500 — mutual fund investing in Pakistan is easier than ever.

Top Investment Apps in Pakistan

Some popular apps for investing in mutual funds in Pakistan include:

UBL Funds Smart Savings — A user-friendly app to open mutual fund and pension fund accounts, track investments, and redeem units easily.

HBL Savings — A digital investment platform by HBL Asset Management that allows easy onboarding, real-time fund performance monitoring, and market updates.

Al Meezan Investments — Pakistan’s leading Shariah-compliant asset manager offers this app to manage your investments, view market data, and explore NAVs with calculators.

These apps simplify the investing process and allow you to monitor your mutual fund investments in real-time with ease.

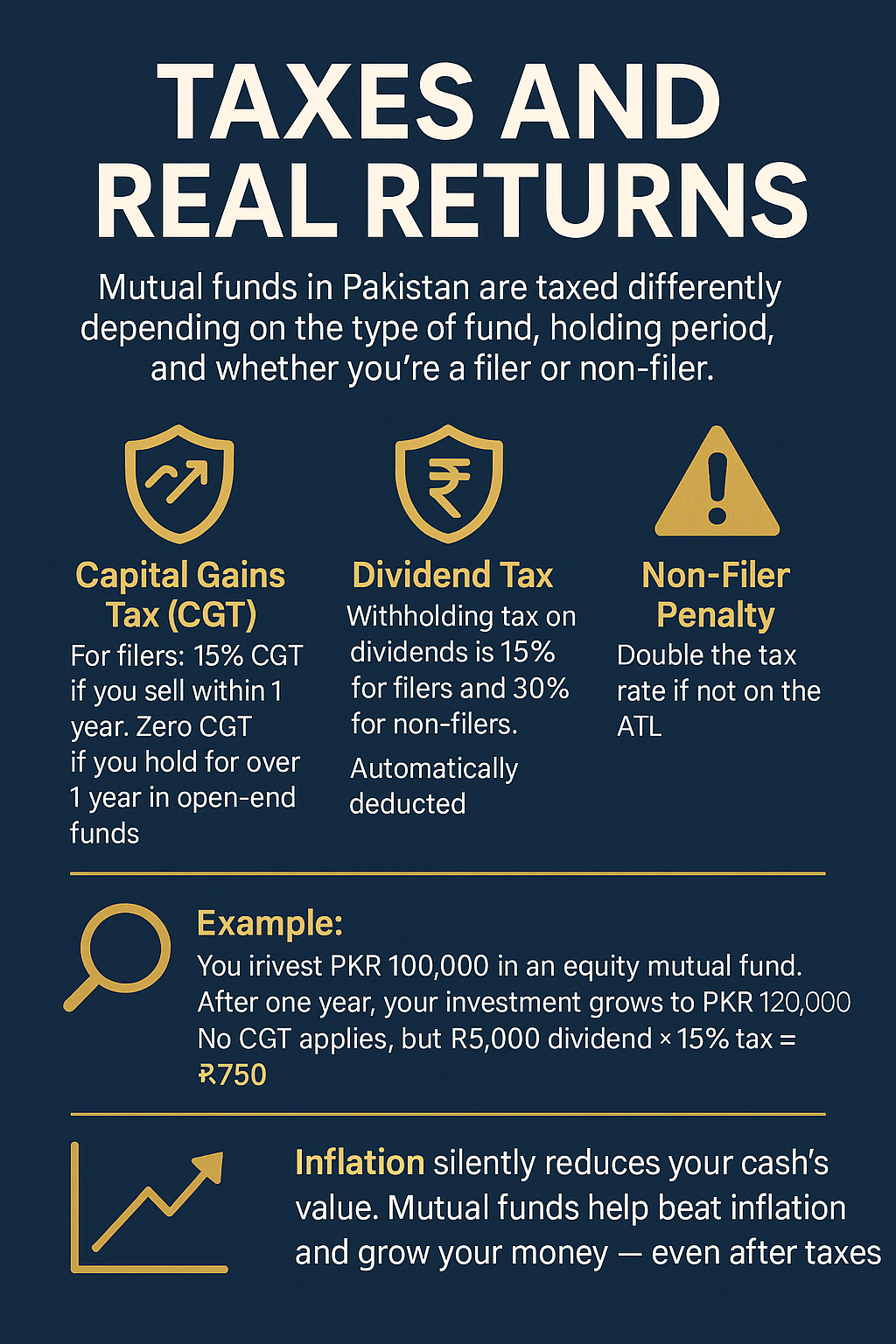

Taxes and Real Returns

Mutual funds in Pakistan are taxed differently depending on the type of fund, your holding period, and whether you're a filer or non-filer. Understanding these taxes helps you calculate your true returns — after tax and inflation.

Mutual fund profits are taxed, but they still help beat inflation. Long-term investing, even after taxes, delivers better real returns than savings accounts.

- Capital Gains Tax (CGT):

- For filers: CGT is 15% if you sell your units within 1 year.

- No CGT if you hold units for more than 1 year in open-end mutual funds (as per Section 62 of the Income Tax Ordinance).

- Dividend Tax:

- Withholding tax on dividends is 15% for filers and 30% for non-filers.

- This is automatically deducted before payout or reinvestment.

Non-Filer Penalty: If you're not on the FBR Active Taxpayer List (ATL), your tax rate may be double — reducing your returns significantly.

🔍 Example: Let’s say you invest PKR 100,000 in an equity mutual fund. After one year, your investment grows to PKR 120,000 — a PKR 20,000 capital gain. If you’re a filer and hold for over a year, no CGT applies. But if the fund paid a PKR 5,000 dividend, 15% (PKR 750) will be deducted as tax.

In contrast, if you had held that cash in a savings account or prize bond, your returns might have been lower — and still subject to withholding taxes.

But taxes are only one side of the story. Inflation silently reduces the value of your money. If inflation is 20% and your investment grows by 15%, your real return is actually negative.

That’s why the goal should not just be earning profits — but earning inflation-beating, tax-smart returns. Mutual funds, especially equity and balanced funds, can help you stay ahead.

Conclusion — Should You Invest?

Mutual funds aren’t just an investment — they’re a smart starting point for every Pakistani who wants their money to grow without diving deep into the complexities of individual stocks or real estate.

Whether you're a student, a salaried professional, or a business owner — mutual funds give you access to expert management, diversified risk, and inflation-beating returns, often with just a few thousand rupees.

In a country where inflation eats into savings, and real estate or stocks require big capital and time — mutual funds offer the balance between growth and peace of mind.

You don’t need to be rich. You don’t need to be a finance expert. You just need to start — and let time and discipline do the rest.

Mutual funds are where everyday Pakistanis become long-term investors — silently, steadily, and smartly.